Nvidia has projected third-quarter revenue that exceeds Wall Street expectations, fueled by relentless demand for its artificial intelligence chips. The company anticipates sales of around $54 billion, plus or minus 2%, surpassing analyst forecasts of $53.14 billion, according to LSEG data. The outlook notably excludes any shipments of its H20 chips to China.

Despite the optimistic forecast, Nvidia’s shares slipped 5% in after-hours trading. Even so, the stock has surged more than a third in 2025, far outpacing the S&P 500’s nearly 10% rise. The company’s second-quarter results also impressed, posting $46.74 billion in revenue, ahead of estimates, though no H20 chips were sold to Chinese customers during that period.

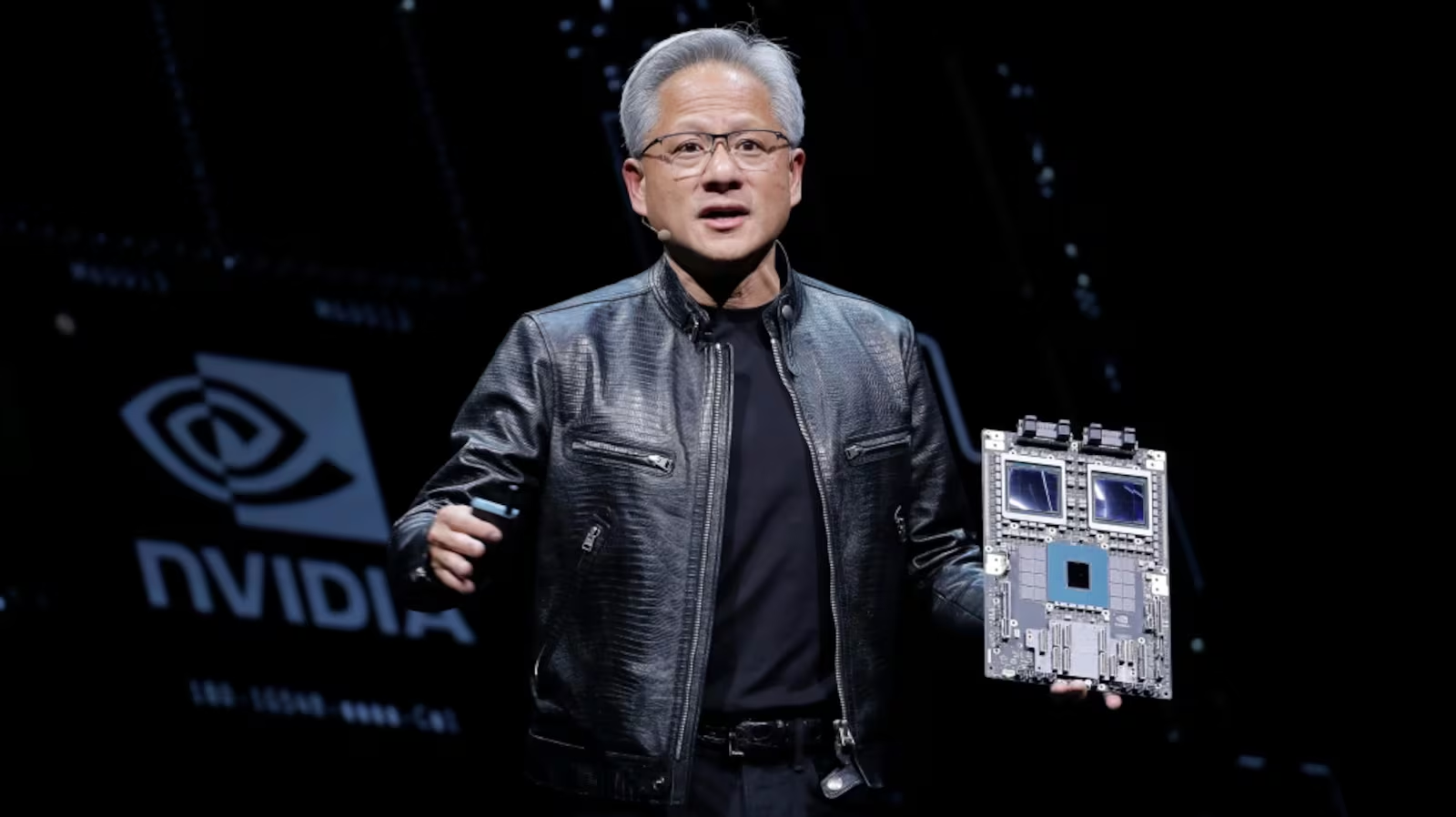

The surge is driven by Big Tech giants like Meta and Microsoft, which continue to pour billions into generative AI infrastructure. Nvidia has become the cornerstone supplier, with its advanced chips powering AI applications that require massive data processing capabilities. Its dominance has also helped drive the broader Wall Street rally in AI-related stocks.

Yet, Nvidia’s growth faces geopolitical headwinds. The ongoing trade war between Washington and Beijing has placed the company in a difficult position. In a rare deal with President Donald Trump, Nvidia agreed to pay the U.S. government 15% of certain revenues in China in exchange for easing restrictions on its H20 chips. Even so, Beijing has discouraged imports, and production of the H20 has been halted. Earlier this year, Nvidia estimated the restrictions would wipe out as much as $8 billion in quarterly sales.

While the challenges in China remain unresolved, Nvidia’s grip on the AI chip market continues to strengthen, keeping investor enthusiasm alive and ensuring the company remains at the center of the global AI race.