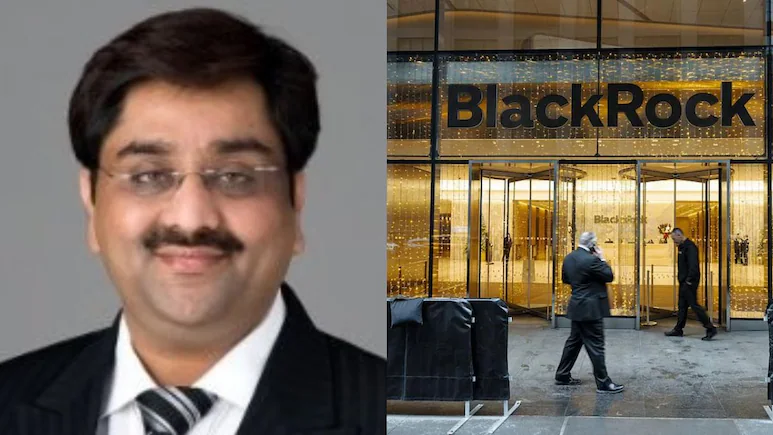

New York / New Delhi — In what has been described as one of the largest private-credit frauds in recent years, Indian-origin telecom executive Bankim Brahmbhatt has been accused of masterminding a $500-million loan fraud that ensnared BlackRock’s HPS Investment Partners and several other global lenders, including BNP Paribas, according to a Wall Street Journal report.

The alleged scheme, which spanned several years, involved fabricated invoices, forged client correspondence, and falsified accounts receivable that were used as collateral for massive private loans. The lenders’ lawsuit, filed in the United States in August 2025, claims that Brahmbhatt’s companies — including Broadband Telecom, Bridgevoice, and affiliated entities under Carriox Capital — built an “illusion of financial health” while secretly diverting millions to offshore accounts in India and Mauritius.

A Web of Fraudulent Dealings

Court filings reviewed by the Wall Street Journal reveal that HPS began lending to Brahmbhatt-linked firms as early as September 2020, with financing later expanding from $385 million in 2021 to approximately $430 million by August 2024.

The loans were partially underwritten by BNP Paribas, one of Europe’s largest financial institutions, which helped facilitate the credit line but has declined public comment on the ongoing case.

At the time, auditing firms Deloitte and CBIZ were retained to verify company assets and conduct annual reviews, but both have remained silent since the allegations surfaced.

Discovery of the Fraud

The alleged deception began unraveling in July 2025, when an HPS employee uncovered suspicious email domains used to confirm invoices — many of which mimicked legitimate telecom clients but were later found to be fabricated accounts.

According to investigators, some correspondence attributed to major telecom operators was completely falsified. When confronted, Brahmbhatt allegedly brushed off concerns before abruptly cutting off communication with HPS officials.

An HPS representative who later visited the firm’s Garden City, New York headquarters found the offices locked, deserted, and stripped of activity. Nearby tenants told reporters they hadn’t seen employees for several weeks.

At Brahmbhatt’s upscale residence in the same area, multiple luxury vehicles — including a Porsche, BMWs, Tesla, and Audi — were found parked outside, while unopened packages were seen accumulating by the front door.

The Investigation and Lawsuit

HPS subsequently engaged the law firm Quinn Emanuel Urquhart & Sullivan LLP and accounting firm CBIZ to conduct an internal probe. The investigation reportedly found that all customer emails provided by Brahmbhatt’s companies over the past two years were fraudulent, and that several contracts dated back to 2018 were forged.

A prominent example cited in the lawsuit involved BICS, a Belgian telecom company, which confirmed in July that it had no association with the invoices or emails allegedly linked to Brahmbhatt’s firms.

“This was a confirmed fraud attempt,” a BICS spokesperson told investigators.

The lenders’ complaint states:

“Brahmbhatt created an elaborate balance sheet of assets that existed only on paper, misleading lenders into believing his companies were solvent while diverting funds offshore.”

Repercussions for BlackRock and the Private-Credit Market

The scandal comes at a critical juncture for BlackRock, which acquired HPS Investment Partners earlier this year as part of its strategic expansion into private-credit markets. The revelations have raised questions about due diligence and oversight in the booming private lending sector, which has grown to an estimated $2.1 trillion globally.

Financial analysts have called the case “a wake-up call” for the investment community.

“This is a breathtaking example of how even the most sophisticated lenders can fall prey to layered financial deception,” one Wall Street analyst told NDTV.

As of now, Brahmbhatt’s whereabouts remain unclear, and neither he nor his legal representatives have issued a public statement.