In a significant move, the Bank of Canada has reduced its overnight rate by 25 basis points, marking the first rate cut since the onset of the pandemic. The policy rate now stands at 4.75 per cent, down from 5 per cent, a level it had maintained since July of last year.

The decision to lower the rate comes after a series of increases that began in March 2022, prompted by unexpected inflation surges due to pandemic-related stimulus measures and global supply chain disruptions.

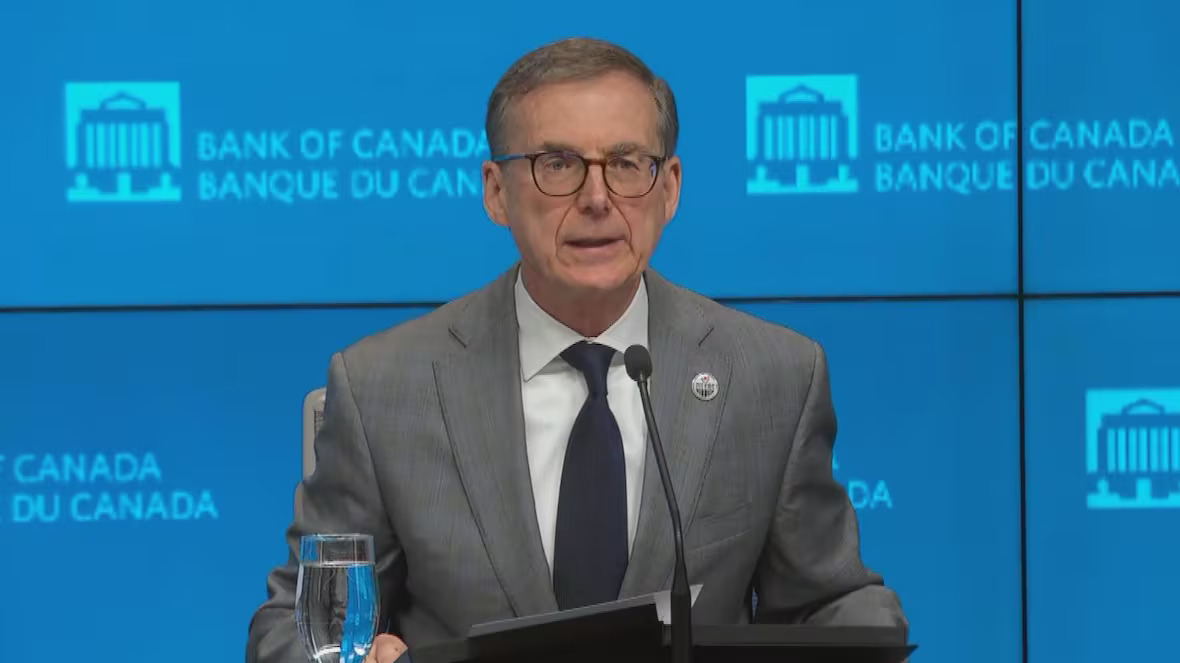

“We’ve come a long way in our fight against inflation,” stated Bank of Canada Governor Tiff Macklem in prepared remarks from Ottawa. “Our confidence that inflation will continue to move closer to the 2 per cent target has increased over recent months.”

The central bank’s decision makes it the first among its counterparts at the Bank of England, the European Central Bank, and the U.S. Federal Reserve to cut rates, citing sufficient evidence that underlying inflation is sustainably easing.

“We don’t need to move in lockstep with the Federal Reserve,” Macklem added. “We have our own currency and a flexible exchange rate, so our decisions are tailored to the needs of the Canadian economy.”

In April, Canada’s inflation rate stood at 2.7 per cent, a slight decrease from 2.9 per cent in March. The economy saw a growth rate of 1.7 per cent in the first quarter of 2024, which was below initial forecasts by the bank.

“Growth has resumed in the first quarter, and we are closely monitoring our growth trajectory,” Macklem noted. “It appears we are heading for a soft landing, but we must remain vigilant as we approach the final stages.”

April also saw an employment increase of 90,000, primarily in part-time positions. Although employment growth has not kept pace with the working-age population, it has helped balance job vacancies and ease wage pressures.

Despite the positive indicators, Macklem cautioned about the risks to the inflation outlook and emphasized that future rate cuts would be considered on a meeting-by-meeting basis.

“If we lower our policy interest rate too quickly, we could jeopardize the progress we’ve made,” he warned. “Further progress in reducing inflation is likely to be uneven, and risks remain.”

These risks include geopolitical tensions and rising housing prices. Bank of Canada Senior Deputy Governor Carolyn Rogers pointed out the housing market’s potential impact on inflation.

“There is some pent-up demand in the housing market, and we’ll have to see how it develops,” Rogers