An Ontario man says he lost $260,000 after becoming the victim of a highly convincing “pump-and-dump” investment scam that used fake online forums and the branding of a well-known financial company to lure unsuspecting investors.

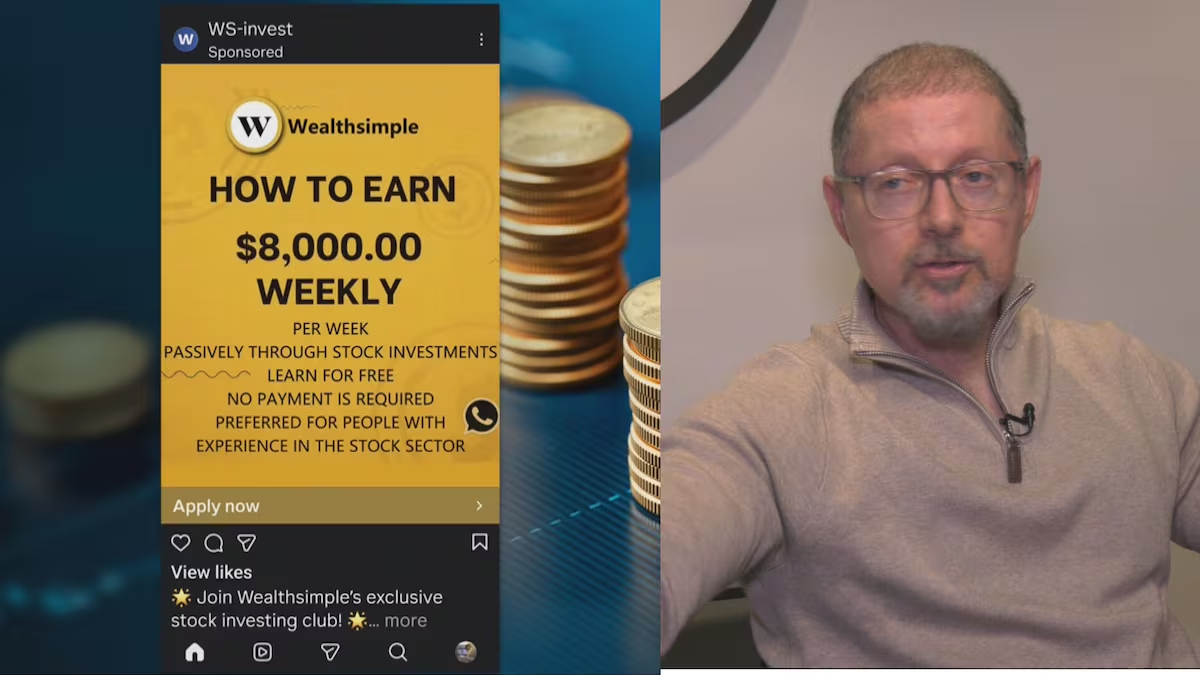

The scam began after the Richmond Hill resident transferred his investments from a major Canadian bank to an online investment platform, drawn in by a promotional offer. Shortly after making the switch, he began seeing advertisements on social media promoting an online stock trading forum. The ads prominently displayed the name and logo of the reputable investment company, giving the impression that the opportunity was legitimate.

Believing the offer was genuine, he joined the online group and followed its early stock recommendations. His first investment appeared successful, doubling in value and earning him a profit of $14,000 after he was advised to sell. That early gain gave him confidence in the advice being offered.

Encouraged by the initial success, he made a much larger investment soon after. Within minutes of purchasing the stock, its value collapsed dramatically, plunging from $1.68 U.S. to just ten cents. Panicked, he watched as hundreds of thousands of dollars vanished almost instantly.

When he attempted to reconnect with the online group for answers, the forum had disappeared. Phone numbers, messages, and contact information were suddenly gone, leaving him with no way to trace those behind the scheme.

The man later learned he had fallen victim to a classic pump-and-dump scam, a fraud in which criminals artificially inflate the price of a stock by spreading hype and false information, then quickly sell off their own shares. Once the stock collapses, the scammers walk away with the profits while investors are left with massive losses.

The financial company whose branding was used in the scam said fraudsters are becoming increasingly aggressive and sophisticated, particularly on social media. The firm noted it has reported thousands of fraudulent ads in recent months and emphasized that it never recommends specific stocks or investment opportunities to clients. It urged Canadians to be cautious of financial advice that promises unusually high or fast returns.

The victim says the loss has forced him to rethink his retirement plans and left him emotionally shaken. He described sleepless nights replaying his decisions and struggling to understand how he was deceived.

Experts warn that promises of quick or guaranteed profits should always raise red flags. Most legitimate investments grow slowly over time, and any opportunity that claims to double money rapidly deserves close scrutiny. Investors are also advised to be wary of social media ads using the logos of trusted financial institutions, as they may be sophisticated fakes designed to exploit trust and familiarity.